To make banking with us more rewarding, we've reimagined how you access, manage, and control your credit. With us, applying for credit is a seamless digital experience, and we don't give you credit based only on traditional criteria.

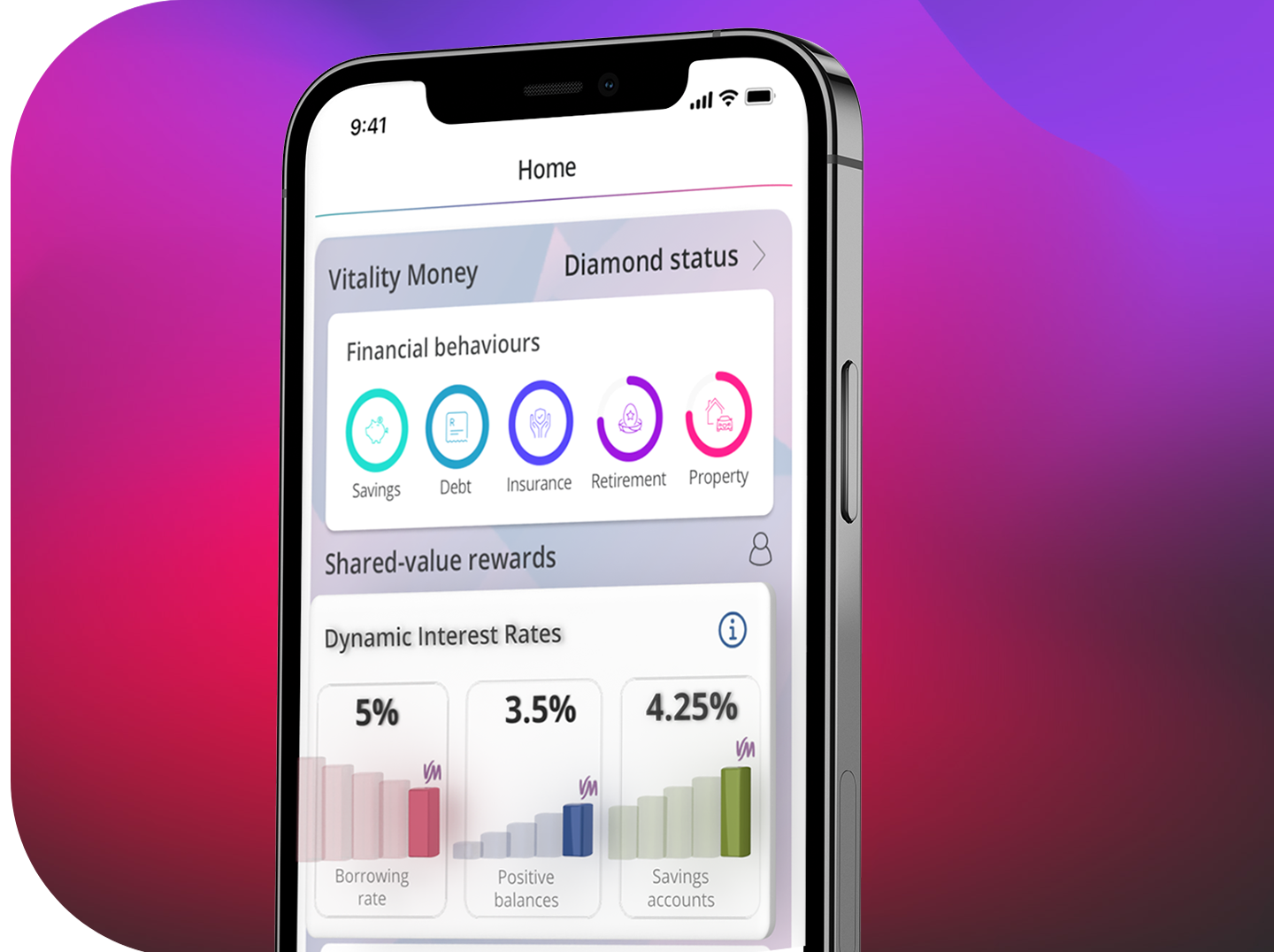

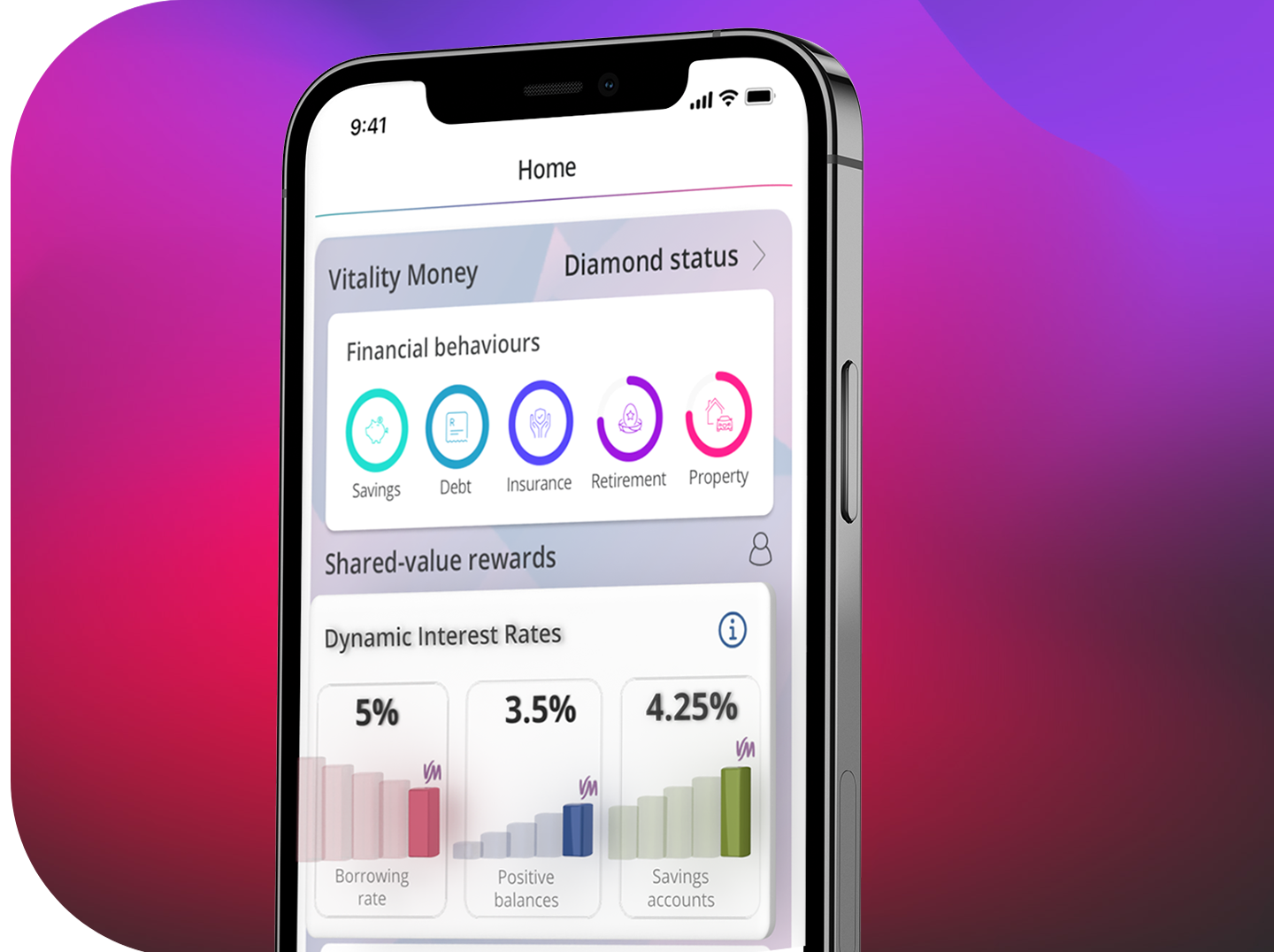

Through Vitality Money, you can control your interest rates when you manage your money well. By improving your Vitality Money status, you unlock the power of Dynamic Interest Rates, and you can pay up to 7% less on your borrowing rate - that's as little as prime -2%!

You can upgrade to a new Discovery Bank Black or Purple Suite and get credit that is backed by your qualifying Discovery investments.

With our single credit facility, you get to choose how much of your credit to allocate between your credit card and transaction account.

Speak to your financial adviser today for more information.

Exclusive to Discovery Bank Black and Purple Suite clients.

We make managing your credit simple and convenient. With our single credit facility, you get one credit agreement for all your day-to-day banking and credit card accounts.

That means if you have a Discovery Bank Suite, you automatically get access to an overdraft on your transaction account, plus the borrowing facility on your credit card account.

One credit agreement means one borrowing rate, with one overall credit limit. This gives you the freedom to choose how to allocate it between your accounts. Had more debit orders this month than expected? Simply shift your available credit from one account to the other in just a few taps on the banking app.

And best of all - all accounts linked to your single credit facility enjoy the same dynamic borrowing rate that you can reduce by up to 7% when you manage your money well with Vitality Money.